In every area of our lives, there will be factors whose changing behavior over time directly influences what we experience.

For a simple example, let's consider someone who invests in the stock market. Every day on the car ride home, the evening news will report on the progress of the Dow Jones Industrial Average (DJIA) and the Nasdaq Average. Possible statements might be:

- the Dow was up by 84.36 points (or 0.81%) today to 10,469.84

- the Nasdaq rose today by 26.71 points (or 1.31%) to 2,061.27

The statements might also be simplified or abbreviated to statements such as:

- the Dow was up by over 84 points today

- the Dow rose today to 10,469

- the Nasdaq was up 1.3% today

- the market rose today for the 3rd day in a row for a net gain so far this week of 1.7%

Anyone who has gone to a stock market charting web page such as Big Charts

http://bigcharts.marketwatch.com/default.asp?siteid=&avatar=seen&dist=ctbc

will of course find a lot more interesting information about how these two indices changed over the course of the day in small side by side time series graphics. Clicking on the DJIA graphic reveals the one year roller coaster history of this average as it has varied between approximately 9,600 and 10,800 (as of 2004 November 11).

The net effect of the most common media reports is to hide most of the potentially important information about how these indices have changed over time. If any patterns are visible in the data, you certainly won't be able to see them if all you know is that the Dow was up 84 points for the day.

If you care about what's happening in the markets, and you think that the Dow or Nasdaq can provide helpful insights for your investing decisions, radically limited data presentations such as the ones that are common on the evening news and that restrict themselves to what happened in the last day, are no help at all and can be dangerously misleading.

Lucky for our hypothetical investor, when it comes to markets, all the time series are all dutifully collected, archived, and available (often for free) to the interested investor who is willing to invest some time. Our investor could look at the detail of today's behavior of the Dow (rising steadily during the day on November 11), or use the various on-line tools to view the past week, month, year, or even 10 year period for this index.

In other important areas of our lives, the same approach turns out to be just as important, but may prove to be a lot more difficult to achieve - a topic we will delve into with future posts.

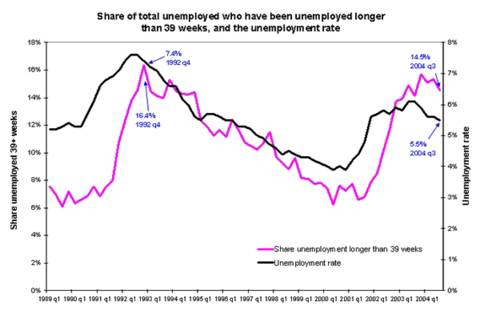

Even in the stock market case where the time series are widely available, the over emphasis and focus on the Dow and Nasdaq may steer our investor away from paying sufficient attention to other important factors such as the value of the dollar vs the euro, the trends shown by the leading economic indicators, changes in treasury bond rates, and so on.

A question we will tackle in future posts will be too consider:

How many factors do you have to examine before you have enough?